The fossil fuel industry brings in a staggering amount of money to countries all around the world, but that doesn't mean it will last forever.

An important new study has predicted that global demand for fossil fuels is going to plummet in the near future, causing a huge "carbon bubble" up to 16 times bigger than the one that caused the 2008 financial crisis.

The research reveals that the global transition away from fossil fuels is likely inevitable, regardless of whether major nations adopt climate polices that promote renewable energy.

The study flies in the face of world leaders like President Trump, who have promised to revive the struggling coal industry at the expense of renewable energy.

"Our analysis suggests that, contrary to investor expectations, the stranding of fossil fuels assets may happen even without new climate policies," said co-author Jorge Viñuales, the chair of Law and Environmental Policy at Cambridge University.

"This suggests a carbon bubble is forming and it is likely to burst."

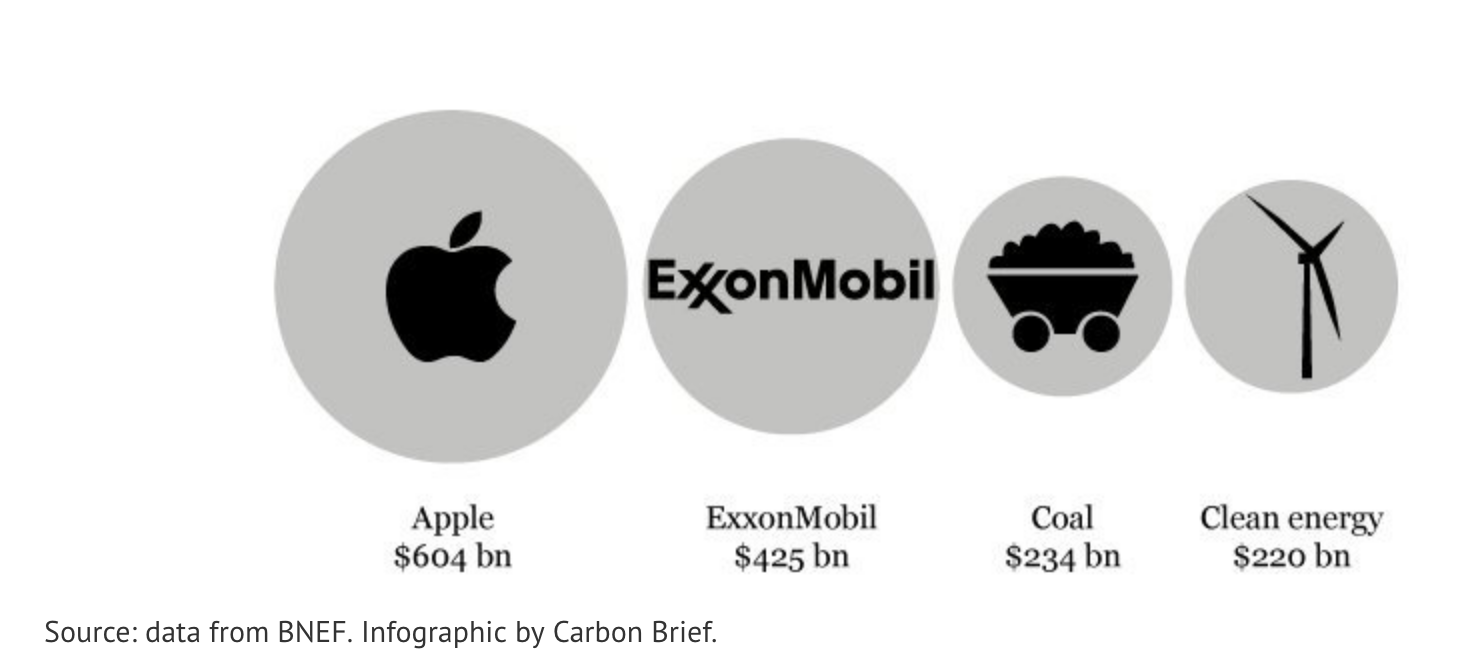

The fossil fuel industry is worth so much that it is borderline incomprehensible for the average person to wrap their mind around.

Today, there are nearly 1,500 oil and gas firms listed on stock exchanges around the world, and together they are worth a whopping $4.65 trillion. Exxon Mobil alone is worth $425 billion.

Using detailed simulations based on historical economic and environmental data, an international team of researchers has illustrated what could happen if this financial rug is pulled out from underneath us.

The research reveals that on our current trajectory, the fossil fuel industry will be forced to abandon vast reserves of fossil fuels sometime before 2035.

Overall, this would amount to a loss of between $1 trillion and $4 trillion in fossil fuel assets alone - roughly four to six times bigger than the 2008 financial crisis, which triggered the loss of $0.25 trillion.

"Individual nations cannot avoid the situation by ignoring the Paris Agreement or burying their heads in coal and tar sands," said Viñuales.

"For too long, global climate policy has been seen as a prisoner's dilemma game, where some nations can do nothing and get a 'free ride' on the efforts of others. Our results show this is no longer the case."

The study should set off alarm bells for major carbon exporters like the USA, Russia and Canada. The researchers have warned that if these countries continue to prop up their fossil fuel industries while neglecting green alternatives they will experience severe financial losses in the future.

The findings come one year after the Trump administration announced its decision to withdraw from the Paris accord, which seeks to curb emissions at 2 degrees Celsius.

Plus, just this month, President Trump announced his administration would be taking steps to bolster dying coal and nuclear power plants in the US.

Still, President Trump's policies are nothing new. To this day, the US continues to provide $27 billion in subsidies for the production and consumption of fossil fuels each year, the most of any industrialized nation, according to a recent report from the National Resources Defense Council (NRDC).

But if the US does not start divesting from fossil fuels and soon, the financial cost will be drastic. The study suggests that if fossil fuel demand declines and the Paris climate goals are met, an initial $4 trillion of fossil fuel assets will be lost completely.

The deficit will be nothing less than a global financial catastrophe, causing mass unemployment and political upheaval. The study's authors worry that the ensuing public turmoil will give rise to populist politics - something that has already been popping up recent in the US, the UK and Europe.

"If we are to defuse this time-bomb in the global economy, we need to move promptly but cautiously," said study co-author Hector Pollitt from Cambridge Econometrics.

"The carbon bubble must be deflated before it becomes too big, but progress must also be carefully managed."

The researchers believe that China is poised to benefit the most if the carbon bubble does indeed pop.

"China is already a world leader in renewable energy technologies, and needs to deploy them domestically to tackle dangerous levels of pollution," said Viñuales.

"Additionally, stranding would take a higher toll on some of its main geopolitical competitors. China has a strong incentive to push for climate policies."

The research suggests that if the US does not start divesting from fossil fuels, China will lead the way in future energy markets.

The study has been published in Nature Climate Change.